Do you know? Different types of companies offer various insurance policies for rental car insurance in California. In California, rental car insurance likely refers to the insurance choices given by rental car businesses to protect renters from accidents, damage, and robbery. Now, the Department of Insurance in California tells the customer that rental car insurance is an essential point. You need to insure your rental car. It does not matter which source you use for a rental car—through the traditional rental agency or a Personal Vehicle Sharing Programme (PSVP).

How many Types of Rental Car Insurance

Rental car insurance is a plus point for renters because they are always afraid of their cars. This insurance was designed for renters because they had a threat of accidents, robberies, and damaging a car. Coverage includes collision damage or loss damage, liability insurance, personal accident insurance (PAI), personal effects coverage, and roadside assistance.

Collision Damage

Rental car insurance covers collision damage in the case of accidents and theft. As we know, a person who gets a car on rent has no headache, but a renter who is the owner of the car always wants to save it. To control the fear and decrease stress, the Department of California encourages customers to sign up for insurance to avoid future problems.

Liability Insurance

Rental car coverage, which is not only fundamental coverage but also a rental agreement, provides liability insurance coverage. To comply with national regulations, rental companies must offer a minimum level of client legal responsibility coverage; however, this minimal insurance won’t be sufficient to protect you in the event of a serious accident fully. You may be liable for harm and the loss of a vehicle. That’s why you are personally liable for the remaining expenses.

personal accident insurance

Rental car insurance covers personal accident insurance that provides financial protection for you and your passengers. If you faced an accident by misfortune, personal accident insurance would cover an accident resulting in bodily injury. Liability coverage for damages to cars and property, but personal accident insurance suffices to cover medical expenses you and your passengers incur. This coverage covers the hospital bill, doctor fees, ambulance, and medicine expenses.

Roadside Assistance

Rental car companies provide a valuable service known as roadside assistance. This coverage provides a calm mind for drivers and passengers in the case of emergencies. Rental vehicle businesses provide roadside assistance, a useful service that gives drivers peace of mind and support in the event of unplanned crises while driving. This service guarantees fast help in the event of a flat tire, dead battery, or lockout, minimizing delays to your travel schedule. Roadside assistance provides extensive support to help drivers rapidly handle problems and get back on track.

The expenses we spend on Rental Car Insurance

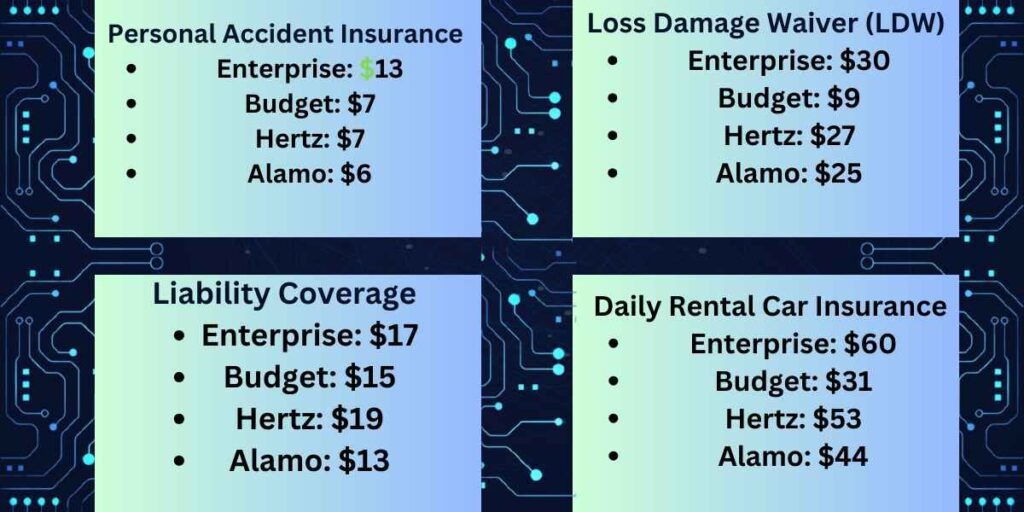

Expenses for rental car insurance vary depending on various factors, such as the type of coverage and extent you choose and the duration of rental car insurance. The expenses also depend on location and vehicle, with a maximum range of $30 to $60 per day. I will describe the costs for each type of insurance across the mentioned rental car companies.

What is the value of rental car insurance?

Costs for rental automobile insurance may rise fast, sometimes doubling the total cost of the rental, especially if full coverage is chosen. Buying insurance for a short-term rental, such as a vacation, is often more expensive than raising your own insurance limits for the year. Autos satisfy the very minimum state regulations, this coverage could not cover damage to the car itself. If I talk about the minimum needed auto insurance in California, companies pay for up to $5,000 in damage to other cars that the renter does, but it doesn’t cover damage to the rental car itself.

The best insurance companies that provide you with rental car insurance

Various insurance companies offer rental insurance, each with its features and benefits.

Bonzah

Bonzah specializes in offering rental car insurance, providing alternatives with collision damage, liability, and roadside assistance. Their focus is on providing low-cost and complete coverage for renters, aiming to guard them from potential financial losses because of accidents, damage, or theft.

Traveler

Traveler is a popular and prominent national insurer known for providing a wide variety of coverage. It provides a lot of benefits and choices, along with exceptional customer care. The rating of 9.5 out of 10.0 is affordable. Travelers offer various services, such as roadside assistance, liability, and historic vehicle insurance. The average cost of comprehensive coverage annually is $1,595 for drivers with favorable credit and driving histories, which is quite inexpensive. Traveler is the most popular insurance company among the top three national companies.

USAA

If USAA insurance had been mandatory for all drivers, we might have ranked it in the first area. Drivers always find reasonably-priced vehicle insurance and an incredible provider from the enterprise. So, if you are a military member or if you’re a member of an army circle of relatives, it could be an awesome idea to get a car insurance quote from USAA. We determined that complete coverage rules from USAA value approximately $1,512 in keeping with 12 months, on average. This changed into the bottom value out of any main issuer we researched.

FAQs

Which rental car company has the best insurance rates?

Price range is the rental vehicle company that has high-quality coverage fees, averaging $31/day. But, always evaluate the value of condo vehicle insurance before buying the first coverage you find.

What is the meaning of a rental vehicle with insurance?

Drivers need to offer their personal liability coverage while renting in California. In widespread cases, US residents have already been covered by their ordinary vehicle insurance. But drivers want to affirm that they’ve got the minimum level of legal responsibility coverage from their business enterprise.

Why is rental car insurance unnecessary?

Rental vehicle insurance is the most expensive if you purchase a full coverage package. If you purchase technically, you don’t need to purchase insurance since rental cars are automatically covered by the minimum requirements in their state.

Does USAA auto insurance cover rental cars?

yes, USAA auto insurance covers rental cars and also provides a Loss damage waiver or collision damage waiver.