Non-performing loans or NPLs, are important components of the financial sector for every civilized. This essay will examine official viewpoints, kinds, and real-world instances as we dissect the definition, causes, and effects of loans (NPLs). Come explore the effects of non-performing loans (NPLs) on financial institutions, bank tactics, and the unique aspects of NPLs in Indonesia. We will discuss the brief overview of the features and properties of non-performing loans that will make their significance and various management strategies clear and transparent

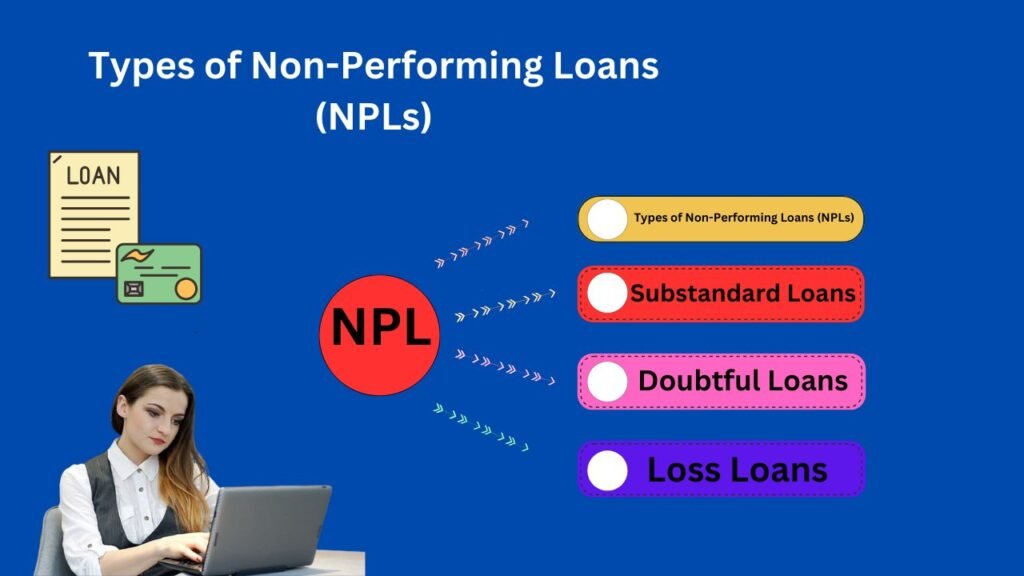

Types of Non-Performing Loans (NPLs)

Understanding the several categories of loans (NPLs) is imperative for calculating risk and executing efficacious management tactics. NPLs may take on a variety of shapes, each with its own special traits.

Substandard Loans

Although they do not yet qualify as irrecoverable, loans classified as substandard have a higher credit risk than usual. Banks actively monitor these loans for any signs of additional deterioration since they offer potential dangers.

Doubtful Loans

Compared to subpar loans, doubtful loans are more likely to default. Since there is little chance of a complete recovery, financial institutions could make large provisions to cover any losses.

Loss Loans

Loans with little likelihood of recovery are considered losses. These loans are often written off as losses because the financial institution does not anticipate being able to collect the amount that is still owed.

Justifications FOR NON-PERFORMING LOANS (NPLS)

Various variables influencing borrowers’ capacity to meet their payment obligations lead to the creation of non-performing loans (NPLs). Financial recessions, job losses, unanticipated expenses, and interest rate increases are common reasons. Financial difficulties brought on by economic volatility can affect both individuals and businesses, increasing the risk of loan defaults.

Bank Indonesia’s Formula for NPL Calculation

As the regulating body, Bank Indonesia offers a method for figuring out non-performing loans. Usually, the procedure involves taking the entire amount of outstanding loans that are non-performing and dividing it by the total amount of outstanding loans. The result is a percentage. This ratio is a crucial sign of a bank’s asset quality and credit risk management capabilities. This formula provides essential knowledge for financial institutions and regulators to evaluate the state of the banking industry and make wise choices about risk control and legislative initiatives.

Impact of-Non-Performing Loans-:

Throughout the financial scenario, Non-Performing Loans (NPLs) have great impacts on both financial institution and the entire economy.

Problems Arising from High NPLs

Liquidity Problems

The liquidity of a bank may change by significant NPL levels. The expected revenues from loan repayments decrease when customers default, making it harder for the bank to fulfill its immediate obligations.

Challenges to Profitability

A bank’s performance exert influence by non-performing loans (NPLs) that results in increase in expenses. NPLs associated with tracking and addressing loan assets in addition to the loss of principal and fascination revenue. The bank is performing an entire economic impact as a result.

Strategies for Resolution

NPL management calls for a large investment of resources. Successful methods to manage non-performing assets, such as recuperating debts, foreclosure, or restructuring, done by financial institutions.

Differentiating NPLs from At-Risk Loans

Identifying among loans that are in danger of becoming non-performing (NPLs) is crucial. Although at-risk loans have a chance of default, they have not yet completed the conditions needed to be labelled. Monitoring these differences and putting preventative measures in place to stop loans from falling into the loan category are essential components of effective risk management. Understanding these categories helps us traverse the complexities of loans. It offers a more nuanced view of the possibilities and challenges involved in managing a variety of loan portfolios.

Non-Performing Loans in Focus (Apa Itu Loan, Bahasa Indonesia)

The degree of borrower payment lateness is characterized by a number of criteria in the context of non-performing loans (NPL). This category offers a detailed examination of the likelihood that a credit.

Problematic Credit

Credit falling into this category is not entirely unrecoverable, but it does suggest a greater-than-average risk of payback. Banks typically keep a careful eye on these loans to spot any indications of future collapse.

Doubtful Credit

Compared to problem credit, doubtful credit has a greater default chance. Since there is little chance of a complete recovery, financial institutions may set aside significant reserves to offset any losses Bad Credit: Credit with extremely low recovery potential is referred to as bad credit. Usually, these credits.