Establishing a bank account in France is not merely obligatory; it is the key to effortless financial dealings and absorption into French society. A regional bank account provides simplicity, and equilibrium, as well as access to key amenities for students, foreign workers, and foreign investors alike. I will look at why you must keep a French banking account, what it provides, and how to get one. Discover how a French bank account may make your daily existence less stressful and lead to new possibilities.

Importance of Having a French Bank Account

A French bank account is extremely essential for people who reside or want to reside in France. The French bank account is so vital, as well as the numerous benefits that it offers to account users.

Improvement of Daily Transactions

One of the primary explanations for establishing a French bank account is to make it easier to make frequent transactions. Consumers with a local account can settle bills, make decisions, and conduct financial transactions without needing to worry about changing currencies or transfers abroad costs. Whether it’s purchasing groceries, paying rent, or dining at a nearby eatery. Having a French bank account streamlines economic contacts and assures effortless transactions within the entirety of the country.

Access to Various Financial Services

A French bank account allows access to an array of important financial services that are offered by local banks. A local account offers access to an extensive selection of financial services and products that are suited to individual demands. It includes checking and savings accounts, credit cards, loans, or options for investing. Whether you want to prepare for the years to come, develop your money, or just manage your finances more efficiently. A French bank account provides you with vital financial services and instruments.

Qualifications for Opening a Bank Take into account in French

French bank account, you have to meet several requirements, including presenting proof of identity, such as a valid passport or national identity card, and proof of address. Which is often in the form of utility bills or rental agreements. Requirements for age vary in each bank, with most needing persons to be a minimum of 18 years old for opening a personal account, whereas specialty accounts designed for children may be accessible with parental approval. Some banks in addition need proof of a paycheck or job to determine your financial health and trustworthiness. It is critical to confirm with the chosen bank for any additional papers required to finish the account-establishing procedure successfully.

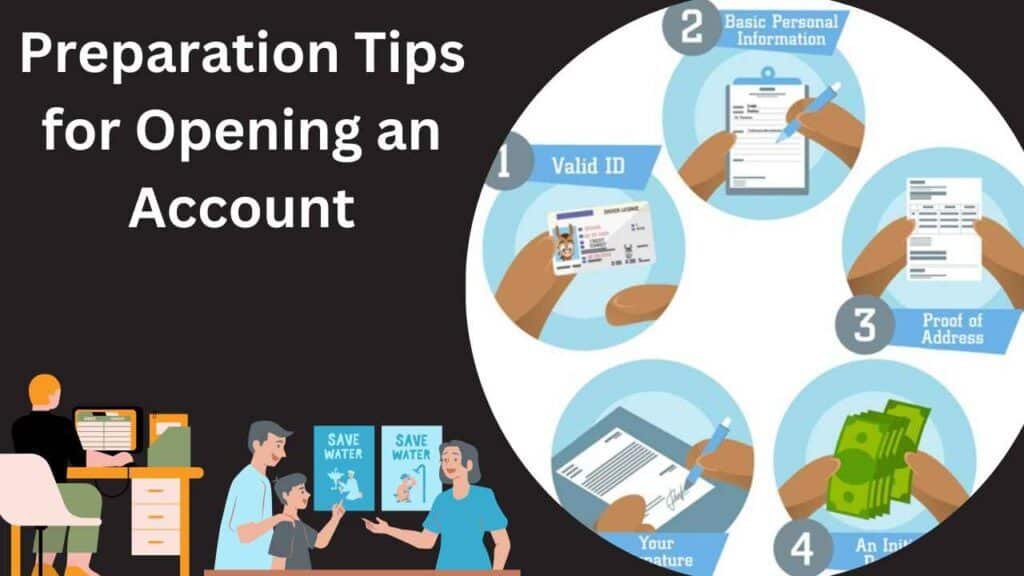

Preparation Tips for Opening an Account

Applying to create a bank account in France involves many essential steps to ensure an effortless transaction. Continue exploring several banking decisions until you find the most suitable one for what you need. Obtain all necessary papers, including evidence of identification, residence, immigration status, and income or employment records. Non-EU citizens should check the visa requirements to guarantee compliance. If you do not speak French fluently, you might consider language-help solutions. Study banking regulations and fees to determine potential costs and limits. Schedule an appointment with your preferred bank and bring enough dollars for the initially made deposit. By following these directions, you may shorten the account registration procedure and begin a successful banking adventure in France.

WeStart Account: Banking for 12-17 Year Olds

Applying to create a bank account in France involves many essential steps to ensure an effortless transaction. Continue exploring several banking decisions until you find the most suitable one for what you need. Obtain all necessary papers, including evidence of identification, residence, immigration status, and income or employment documents. Non-EU citizens ought to verify the requirements for a visa to guarantee compliance. If you do not speak French effectively, you could think about solutions. Study banking regulations and fees to determine possible expenses and limits. Arrange a meeting with your preferred bank and bring along enough dollars for the initially made deposit. By following these directions, you can accelerate the account establishment procedure and begin a successful financial services adventure in France.

Conclusion

In conclusion, opening a French bank account is not just a practical necessity but a gateway to financial stability, convenience, and integration into French society. By fulfilling the requirements and adequately preparing for the process, individuals can smoothly navigate the account opening process and gain access to the myriad benefits of banking in France. Whether it’s facilitating everyday transactions, accessing various financial services, or fostering financial independence from a young age through specialized accounts like WeStart, the French banking system offers opportunities for individuals to manage their finances effectively and secure a prosperous future.