Church building insurance: Identifying entities in need of church insurance is necessary for an extensive range of faith-related institutions, including churches, chapels, temples, and mosques. These groups, irrespective of religion or trust in God, demand insurance to safeguard their physical foundations, events, and initiatives to serve the community. Whether it’s a small local community or an enormous church, all church buildings confront dangers including property damage and liability claims. By identifying those entities that require church insurance, we highlight the necessity of maintaining these honored locations and guaranteeing that they’re able to carry on serving their surrounding areas without interruption.

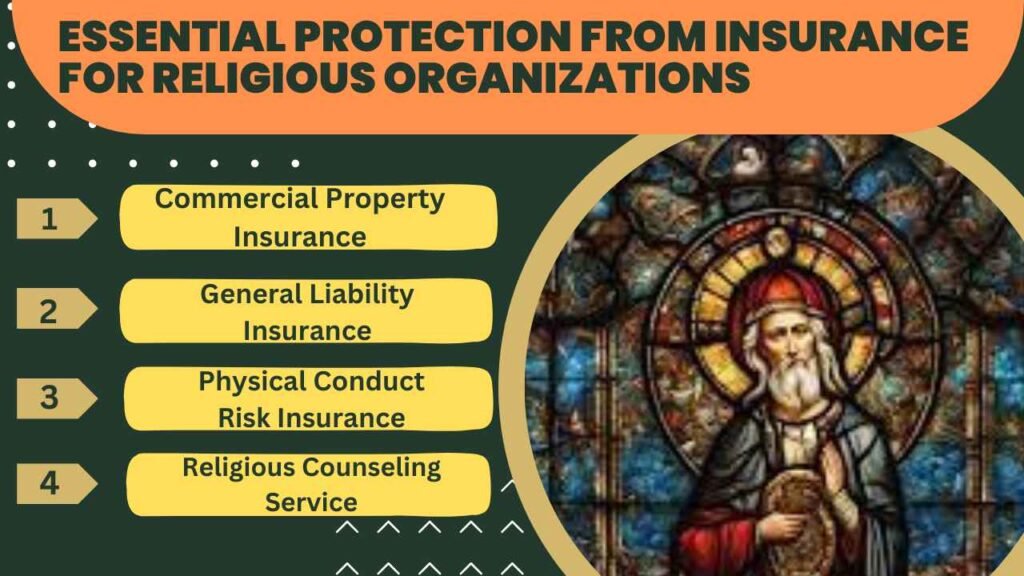

Essential Protection from Insurance for Religious Organizations

Religious institutions require multiple kinds of insurance programs to precisely protect their assets, debts, and operations. These are some important forms of insurance coverage that every faith-based organization should have to consider

Commercial Property Insurance

Addresses physical harm or destruction to the church building, material, and any additional property governed by the religious group. This protection includes circumstances like flames, theft, burglary, and catastrophic weather.

General Liability Insurance

Covering disputes for injuries sustained or harm to property due to mishaps on religious grounds or at church-sponsored tasks. This policy additionally includes legal defense fees in the case of an action against you.

Physical Conduct Risk Insurance

Offers insurance against allegations of sexual assault, neglect, or intimidation against pastors, staff, volunteers, or members of the church. This coverage is critical for dealing with delicate matters while additionally upholding the faith-based institution’s reputation.

Religious Counseling Service Liability Insurance

Covering clergymen or religious leaders who offer therapy services in the execution of their obligations. This coverage gives defense from claims of mental anguish, carelessness, or misconduct.

Establish Adequate Insurance Coverage

Establishing the correct quantity of insurance for a religious group involves weighing a variety of variables to offer full protection against potential dangers. Here are some crucial considerations to consider when deciding on proper insurance coverage

Property worth

Beginning to estimate the worth of the congregation building, comprising its building, material, and any additional assets owned by the organization. Consider the building substances, duration of the structure, and replacement cost projections.

Liability Exposure

Assess people of faith institution’s feasible legal contact, including hazards related to harm to property, harm to others, and legal claims. To establish a suitable degree of insurance for liability, take into account the congregation’s size, regularity of events, and initiatives for outreach.

Specific risks

Identify any risks or weaknesses specific to the spiritual institution, such as its geographical position, weather-related concerns, or the structure’s historic significance. Tailor coverage for insurance to meet these distinctive dangers efficiently.

Looking at Additional Insurance Options for Comprehensive Protection

In addition to the fundamental types of coverage outlined before, faith-based groups might profit from looking into additional coverage alternatives to enhance their general protection. Here are additional coverage substitutes to consider

Business interruption insurance

Provides revenue lost and ongoing costs if the church’s services are stopped temporarily owing to an insured event, such as a fire or catastrophic storm. This type of insurance assists reduce monetary harm and assures the continuation of activities through the recuperation phase.

Cyber Liability Insurance:-

Provides safeguards against data breaches, hackers, and other cyber dangers that could harm sensitive information preserved electronically by religious groups. The policy helps pay the costs of the announcement, credit surveillance, and legal fees related to a cyber incident.

Umbrella Liability Insurance

Provides additional liability protection that exceeds the constraints of main insurance contracts such as general responsibility and car liability insurance. Umbrella coverage provides a further level of safeguarding against catastrophic events or huge liability lawsuits that surpass the initial policy limits.

Factors to Consider When Selecting Church Insurance Policies

When choosing insurance policies for an organization of faith, various criteria must be examined to ensure full coverage. Assessing particular coverage demands, understanding insurance limitations and deductibles, as well and analyzing exclusion and recommendations are all critical tasks. In addition, examining insurance’s financial stability, comparing premium prices, and prioritizing outstanding service to consumers is critical.

Conclusion

Finally, church-building insurance for buildings is critical for safeguarding spiritual organizations’ tangible, monetary, and psychological health. Religious leaders can safeguard their holy places from unanticipated hazards and obligations by recognizing the need for insurance, identifying organizations that require coverage, and picking suitable policies. Adequate insurance protection protects temples, chapels, temples, and temples against harm to property and lawsuits for liability, as well as guaranteeing an uninterrupted flow of activities. Religious organizations may accomplish their mission of helping the community while managing the hazards of a chaotic setting by pursuing sufficient policies along partnering with trained experts in consulting.