Briefly guide to apartment building insurance with types and risks securing proper coverage. It is critical for safeguarding your financial assets and minimizing any harm that occurs. I will look at the several types of insurance policies necessary for apartment complexes, prevalent risks that owners confront, pricing concerns, and risk mitigation measurements. Whether you are an experienced owner or thinking about investing in apartment complexes, this article will provide you with the knowledge you need to protect your real estate and financial objectives.

Types of Insurance Policies for Required Apartment Buildings

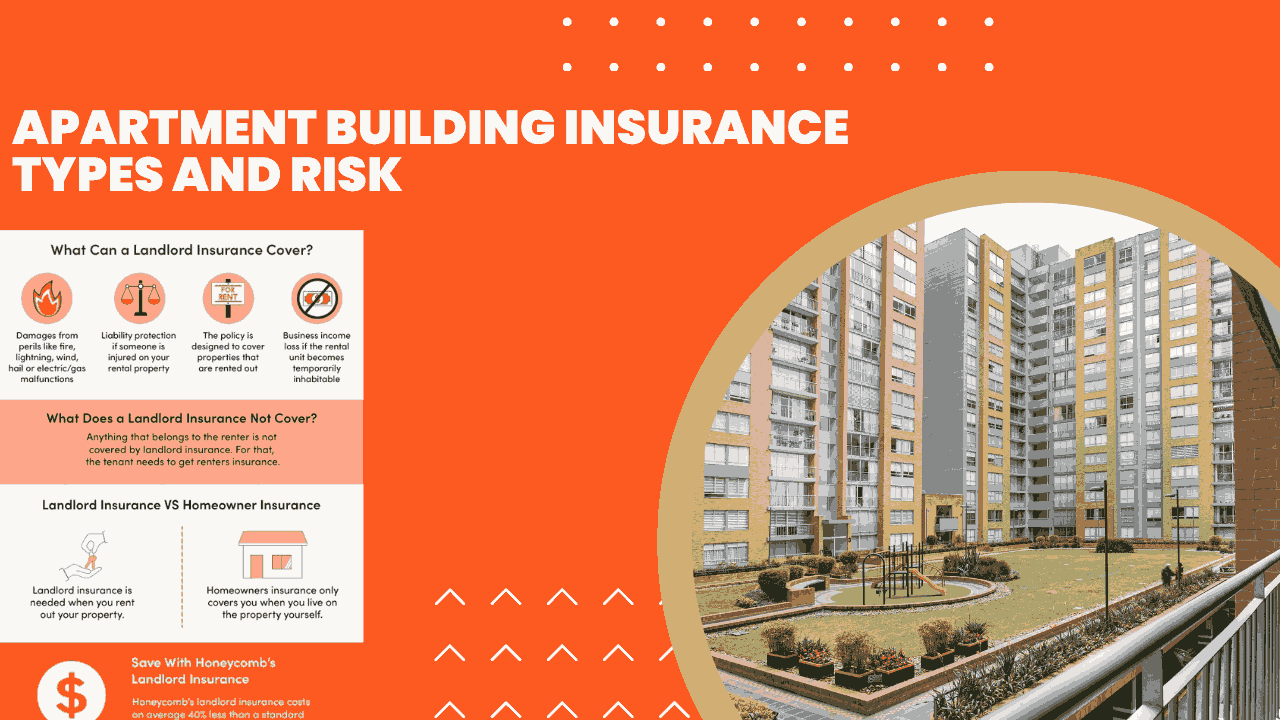

When it involves insuring a complex of apartments, it’s critical to understand the many types of insurance plans that are accessible to safeguard the value of your investment. Here, I will discuss the fundamental insurance plans that are typically necessary for apartment buildings.

Property Insurance

Property insurance safeguards the residential building’s interior and exterior against damage caused by insured risks such as fire, trespassing, and catastrophic events. It usually includes the building itself, in addition to any fittings, equipment, and decor controlled by the landlord.

Business Income Insurance

Business profit insurance, also referred to as company interruption insurance covers lost rental income if the apartment building ends up being unsuitable due to an approved danger.

Liability Insurance

Liability insurance guarantees against legal costs caused by injuries or harm to property experienced by residents or visitors to the premises. The protection will help handle court costs, healthcare costs, and payment in the event of a responsibility or lawsuit claim

Umbrella Insurance

Umbrella insurance supplies extra legal protection outside the boundaries of ordinary insurance for liability plans. It provides an extra layer of safety in instances of disastrous emergencies or large liability claims that transcend the limits of main policy coverage.

Ordinance and Law Coverage

Ordinance and law coverage help pay the expenses of adhering to building rules and ordinances while repairing or constructing an apartment building following a covered loss. This coverage is essential since building regulations may have changed after the facility was built, increasing reintegration costs.

Business Owners Policy [BOP]:

A business owner policy (BOP) is a full insurance package wanted especially for small-scale businesses, particularly housing development owners. It often integrates property insurance, liability insurance, and business interruption coverage into a single policy, providing cost savings and simplified coverage.

Common Risks for Apartment Building Owners

Owning an apartment building entails an array of hazards that might influence both the building and the proprietor’s financial security. Knowing these dangers is critical in creating successful approaches to mitigation and obtaining proper coverage from insurance. I will look at some of the most common dangers encountered by condominium owners.

Property damage

Property damage may arise from an assortment of triggers, including fires, storms, floods, trespassing, and even mishaps. Without sufficient coverage from insurance, replacing or repairing destroyed belongings may be costly and economically burdensome for condominium owners.

Liability Claims

Apartment owners may be held responsible for accidents or damage to property suffered by tenants, tourists, or third parties. Slip and fall occurrences, inadequate upkeep, or dangerous circumstances in the building. It might result in accusations of negligence and dispute resolution.

Loss of Rental Income

Disruptions in rental revenue could occur if housing inside the apartment complex becomes habitable. Due to covered hazards such as fires or natural disasters. Loss of income from rentals can have a substantial impact on cash flow and stability in the economy for apartment building owners.

Tenant Disputes

Responding to landlord issues, including failure to pay rent, contract breaches, or removal methods. It may be difficult and time-consuming for apartment complex owners.

Legal and Regulatory Compliance

Apartment owners must follow a wide range of legal or governmental responsibilities, among which are construction laws, planning rules, landlord-tenant limitations, and comparable dwelling rules. Failure to meet these standards could end in penalties, taxes, or prosecution against the owner in question.

Strategies for reducing risks related to apartment buildings

Combating risks associated with apartment complexes is vital for safeguarding the property, those who rent, and the owner’s financial interests. Employing sound risk management procedures can assist in reducing the likelihood and severity of potential hazards and liabilities. Here are a few important measures for apartment landlords to take to reduce dangers.

Regular Maintenance and Inspections

Adopting a preventive maintenance strategy and conducting frequent inspections of the residential building’s structure, infrastructure, and types of equipment can assist in identifying possible hazards and resolving problems with upkeep swiftly. This consists examining the electrical wiring, plumbing, [HVAC] systems, roofing material, and public spaces to guarantee they remain in proper operating condition.

Tenant Screening and Lease Agreements [TS&LA]:

Undertaking wide tenant inspections for evaluating new homeowners may help lower the possibility of leasing to landlords that have a track record of nonpayment, damage to property, or disruptive behavior. In addition, having well-drafted lease documents that explicitly outline tenant commitments, rules, and laws will help avoid disputes and guarantee lease circumstances are followed.

Emergency preparedness planning

Developing and carrying out an emergency-get-ready plan that determines techniques for dealing with instances like fires, catastrophic events, and medical emergencies is critical for assuring tenant security and reducing property damage. This involves developing escape strategies, identifying emergency contacts, and creating building personnel and inhabitants.

Comparing Landlord Insurance Policies

When researching landlord insurance solutions for real estate developments, it is vital to consider coverage options, policy limits, and deductions to provide sufficient safeguards at an acceptable rate. Assess insurers’ reputation and financial soundness, as well as their customer service & claim resolution timeliness. Additionally, scrutinize policy exclusions and inquire about available discounts to optimize coverage and minimize expenses.

Steps to Protect Your Investment with Apartment Building Insurance

To protect your investment with apartment building insurance, first determine your coverage requirements based on building size, location, and potential dangers. Research trustworthy insurance companies, tailor coverage options to your personal needs, and completely grasp policy terms and conditions. Implement risk management methods, keep correct records, and assess and amend coverage once a year to adapt to changing conditions. Effective communication with renters on insurance needs and safety practices is also critical. Following these measures allows apartment building owners to provide full protection, reduce hazards, and preserve their property’s long-term financial stability.